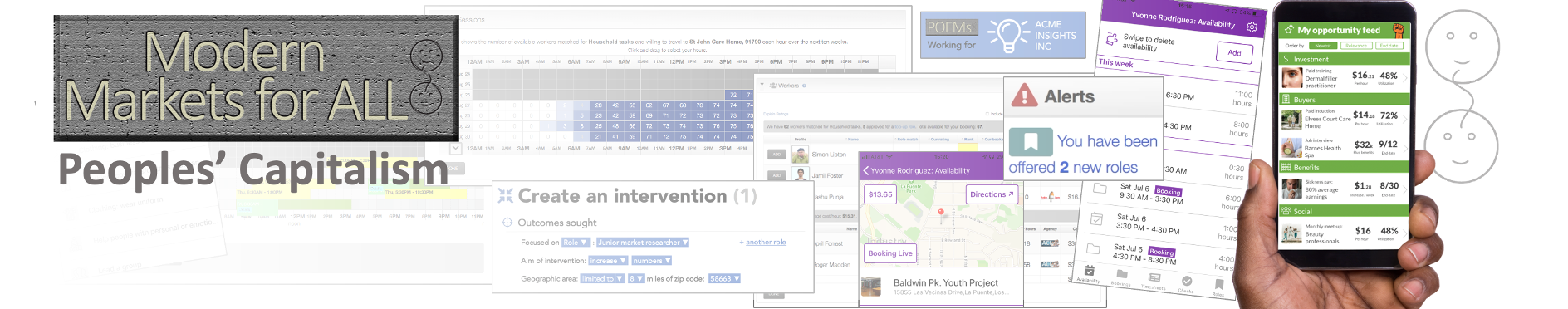

Mark needs to staff a project for this afternoon, pull together a range of resources for a sales event, then set up a new business opportunity. He will do it all while his coffee brews.

Mark needs to staff a project for this afternoon, pull together a range of resources for a sales event, then set up a new business opportunity. He will do it all while his coffee brews.

Mark to market

Acme Insights is a small consumer research company within a group of US states that have initiated a system of POEMs (Public Official E-Markets). Acme is not yet big enough to have full time staff. Mark does two 8-hour days for them each week as Project Manager. They have a rolling arrangement with him that allows POEMs to fit his weekly hours around other work opportunities the system finds him. As long as he remains with Acme he has every incentive to do a good job, his POEMs track record of reliability is dependent on it.

His first task today is completing the company’s research into a client’s reformulated pancake syrup. Weather this afternoon is surprisingly good, so he wants 12 interviewers at a suburban metro station to lure commuters and get them taste-testing. That needs to happen at rush hour, starting at 5PM. It’s now 3PM.

His first task today is completing the company’s research into a client’s reformulated pancake syrup. Weather this afternoon is surprisingly good, so he wants 12 interviewers at a suburban metro station to lure commuters and get them taste-testing. That needs to happen at rush hour, starting at 5PM. It’s now 3PM.

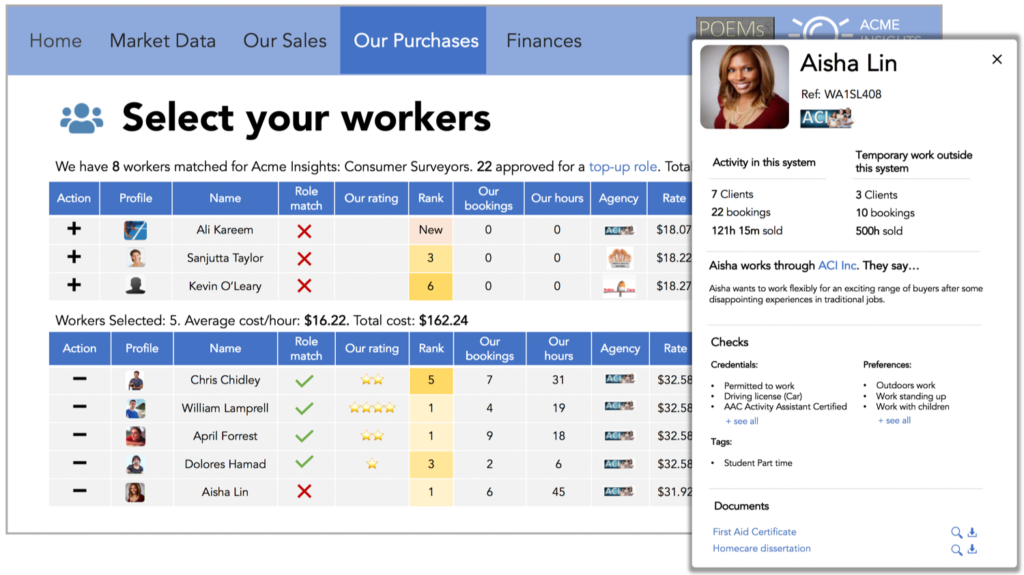

The company has a pool of 30 POEMs workers approved for this kind of survey. Each has been trained and approved by management. And each will likely be in dozens of pools with other businesses in any sector. To create the pool, POEMs was told to find workers within four miles radius who had reached at least POEMs Grade 3 (of 6) reliability with at least 10 bookings for work classed as “customer facing”. Ensuring proximity, track-record, and relevance de-risked investment in their paid training.

Getting the staff

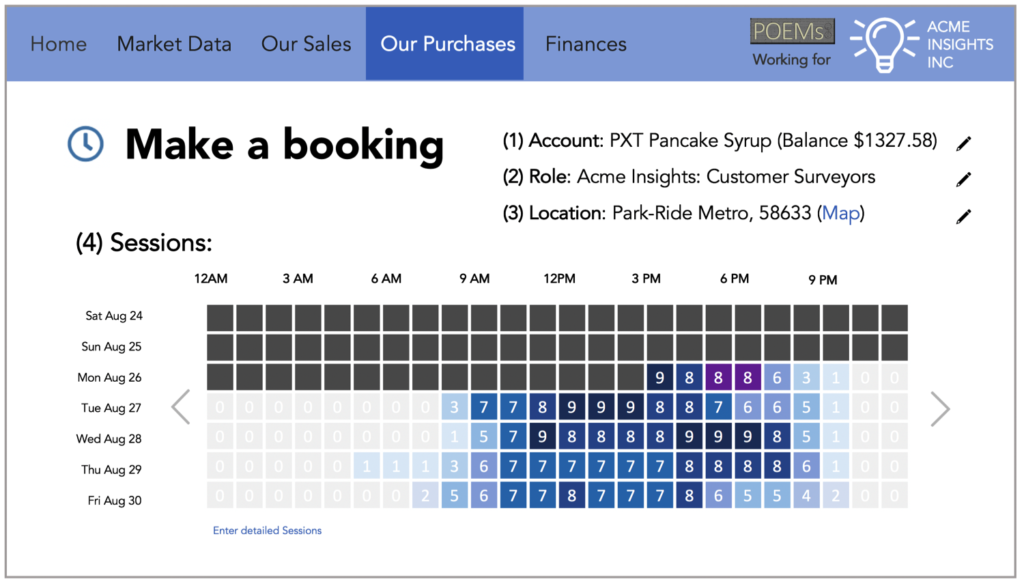

Logging into his Acme account with POEMs, Mark enters his requirements for today. He stipulates the role, which Acme created along with its fixed hourly base pay rate. There are enough sellers to justify a display of stored availability. The system shows him how many of Acme’s pool of “Consumer Surveyors” are available, and willing to travel to this afternoon’s location, each hour. It will do it for the next ten weeks.

This grid contains worrying information. Only 8 of the pool are available from 5PM to 7PM today. Numbers are little better later in the week. Mark consults the POEMs’ role record and sees, 14 of their approved 30 workers have their Acme role set at inactive, probably because they are getting better pay or conditions elsewhere. The rest are not available at his times of need or are already booked by other employers.

He makes a note to tell tomorrow’s board meeting they need to consider training more workers for the pool. Or, POEMs makes it easy for them to push out an enhanced base pay rate which should persuade members of the original batch to turn the role back on.

Once he selects his hours for tonight’s survey, POEMs gives him the 8 individuals’ names and details. To broaden everyone’s options, it has also found 22 individuals who are qualified market researchers, available when required, and willing to travel to the location, but not currently in Acme’s approved pool.

The precise rate at which the 22 extra workers will do today’s booking is dynamically calculated by applying parameters of this assignment (distance to be travelled from home, period of notice, length of booking, and so on) to each person’s personal pricing rules. These people come from multiple labor market intermediaries: Acme chooses not to be a direct employer of researchers. The mark-up set by each competing intermediary has been built in.

Mark will need to pull in interviewers from outside the company’s approved pool to complete tonight’s pancake assignment. He browses profiles of some of the more provenly reliable individuals and assembles his list.

Having picked his 12 researchers, POEMs prompts him for reporting instructions. It deducts the total cost from Acme’s account and transfers it to escrow. Then it contacts each booked worker, however that person wishes, and ensures confirmation. It stands by to find replacements in the unlikely event one of these individuals – each strongly incentivized to maintain their reliability record – doesn’t confirm.

Chain transactions

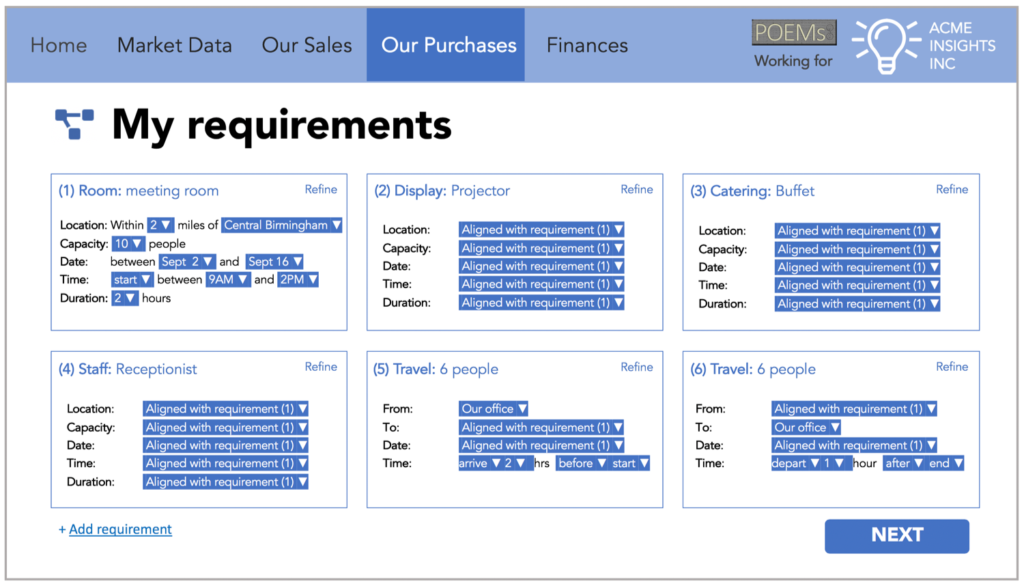

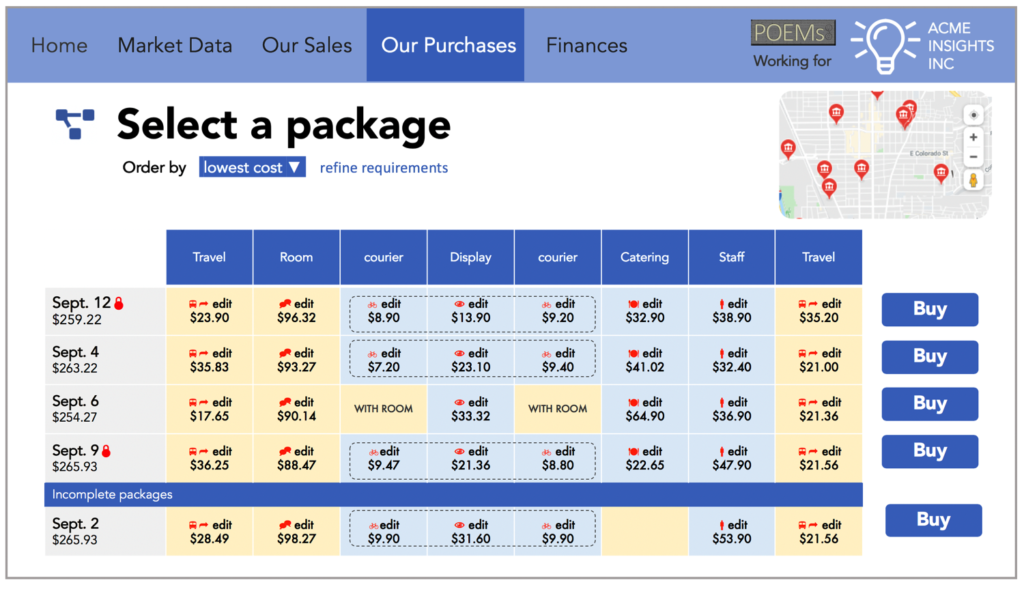

Mark’s next task: arrange an event for a group of potential customers in a distant city. He needs to rent a meeting room, a projector that will have to be transported to the room, catering for the prospective clients, a receptionist, and travel for Acme’s team. He builds the requirements on POEMS.

POEMs’ insiders call this a “Chain Transaction”. The system pulls resources from diverse sellers across multiple markets into customized packages to meet a buyer’s needs.

Packages with a padlock symbol are underwritten by POEMs’ insurance markets. The sellers are reliable enough to attract finance that will be used to replace any part of the chain should one or more default. It’s all seamlessly built into the pricing.

He selects a package then tweaks the travel component. Instead of the minibus and driver POEMs found, he books a “Work Truck”; a Recreational Vehicle tricked out as a mobile office. It’s a nascent market in POEMs, started when sellers began offering the service on its loosely-structured bulletin boards. Like a trending hashtag, POEMs identified the listings and automatically began formalizing that sector; bringing it into the directory of sub-markets, offering it to a franchisee to develop, aggregating data, seeing which mechanisms were popular with sellers, and pulling their offerings into chain transactions. Trailblazing sellers are charging high rates, but the productivity gain for Mark’s bosses makes it worthwhile.

As he clicks to book the entire set of resources, Mark reflects on his competitors outside the POEMs’ states also setting up a sales event; calling round hotels to evaluate their packages, looking for office equipment rental websites, emailing staffing agencies, and getting bids from caterers after explaining requirements. At each step the competitor has sight of only a fraction of the sellers who might meet their needs.

Other users tap POEMs to pull together chains of resources required for house moves, harvesting on a farm, funerals, shopfitting, surgery, building renovations, tailored vacations, and countless other multi-resource purchases.

Creating an intervention

Creating an intervention

The final task before Mark’s mid-afternoon coffee is setting up an investment opportunity. His employers have a unique understanding of market research and their local economy. It gives them an edge over hedge funds, private equity, and other non-localized forms of investment. POEMs encourages Acme to exploit that advantage.

Today’s opportunity? An extensive apartment development is soon to open in their city center. Management have realized its occupants will bring local demographics into line with forecast national averages, creating a magnet for market researchers. Acme can’t own this opportunity. As soon as they advertised it, competitors would set up shop in town. But they can profit by extending their training to create a wider pool of interviewers ready for a local surge in market research activity.

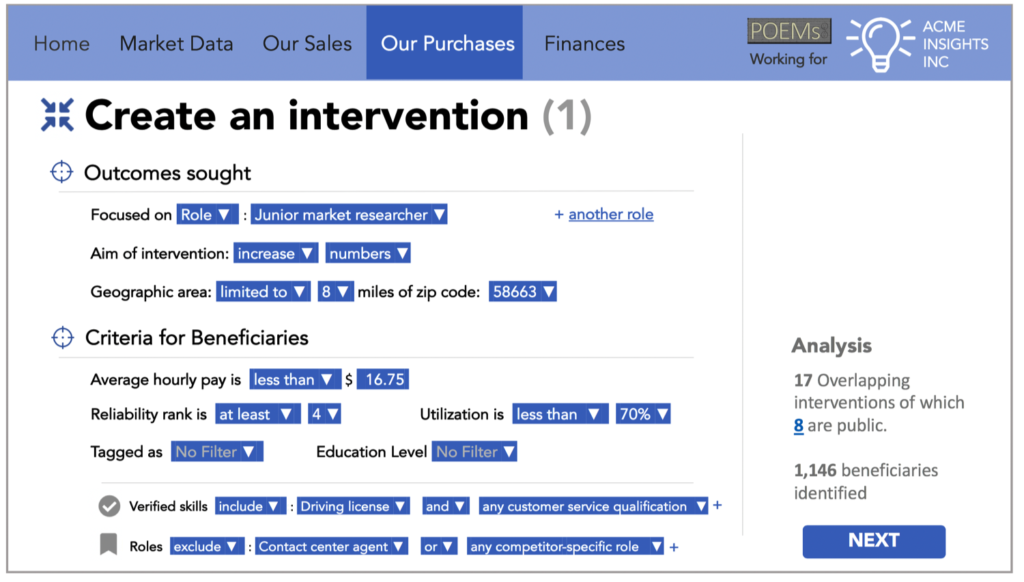

POEMs runs millions of market interventions. Mark calls up the screen to add another:

The focus of an intervention can be buyers, sellers, intermediaries, or skills. For example; public agencies have multiple interventions to subsidize disadvantaged work-seekers or certified carbon neutral small businesses. But Mark’s is about a specific type of work and increasing the numbers involved. Other interventions aim to decrease numbers. For example; if a region is dependent on a manufacturing plant currently buying a lot of lathe operators’ hours but soon to shutter, government workforce officials may start an intervention to reduce numbers dependent on that type of work by funding individualized reskilling.

Mark is again using POEMs rankings to de-risk investment. Charities will often invest in those at the bottom of the POEMs’ ladder for social good, but he needs a return. There’s no point training people who are already selling all their available hours so he has a utilization threshold. And he’s clear on the existing skills of people who Acme will invest in.

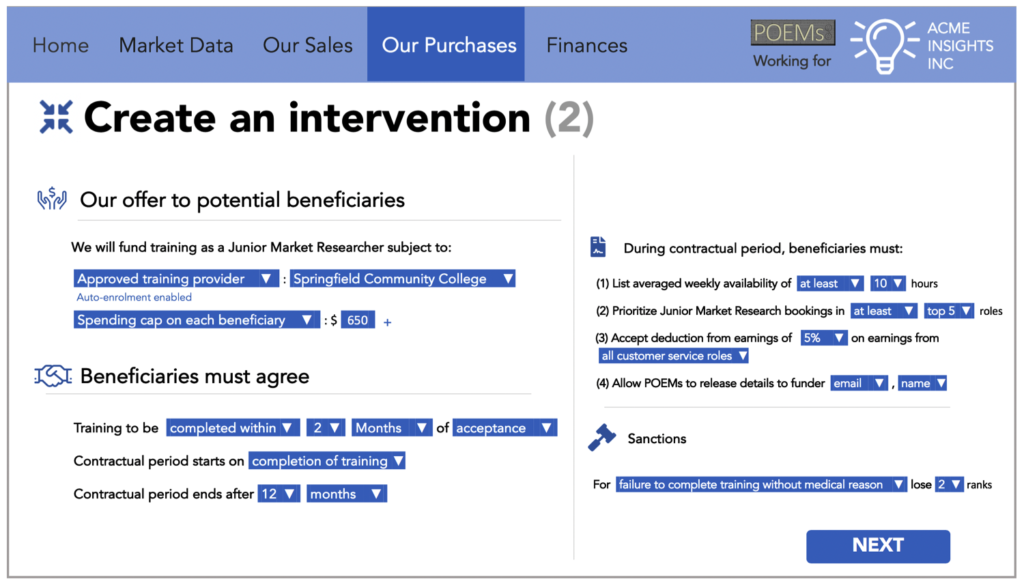

Now he needs to specify what those targeted people will be offered. And what will be demanded in return:

To stop anyone just signing up for paid training and then not trying to earn as a result, Mark inserts a requirement that anyone trained maintain at least 10 hours average weekly availability in POEMs. This new skill will enhance employability so Acme will want 5% of each beneficiary’s earnings in customer service roles, which include market research, as their profit. That’s a broad demand, a lot of users’ filters will ensure this intervention doesn’t even appear on their Opportunity Feed. But Mark can change it to just a percentage of market research earnings later and re-launch the intervention. He’s testing the market at this point.

Now he needs to set parameters for his intervention:

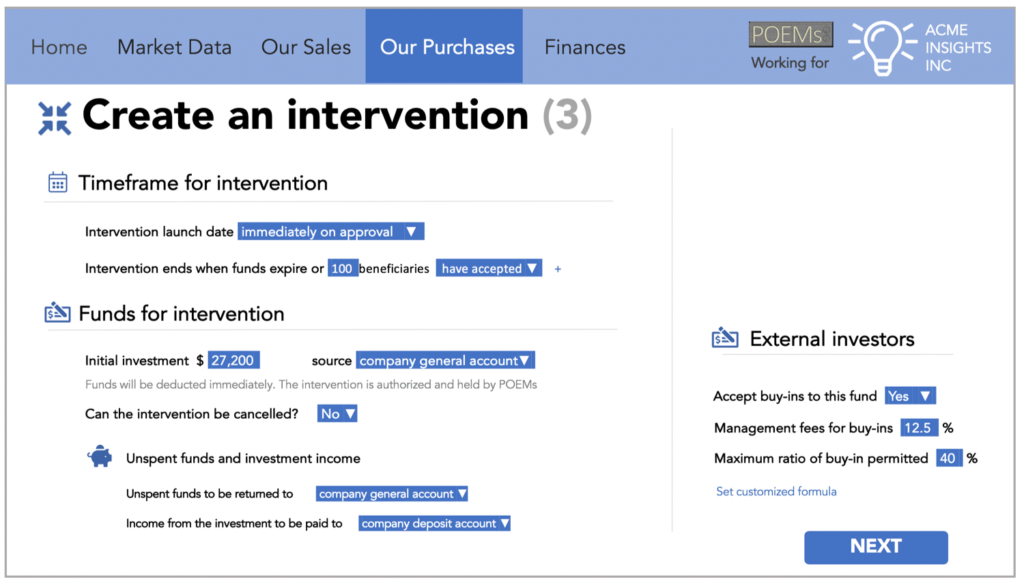

He wants to avoid a saturated market, so there’s a cap of 100 new market researchers to be trained. The company will test the waters with an initial $27,200 investment.

Wall Street algorithms hunt through POEMs’ for-profit interventions looking to buy-in to the best returns. The system encourages that with investment indices, after-markets, funds-of-funds, and futures. Will Acme allow buy-in to the fund they’re setting up for this intervention? They will, but Mark has determined a charge of 12.5% for their local insight and oversight.

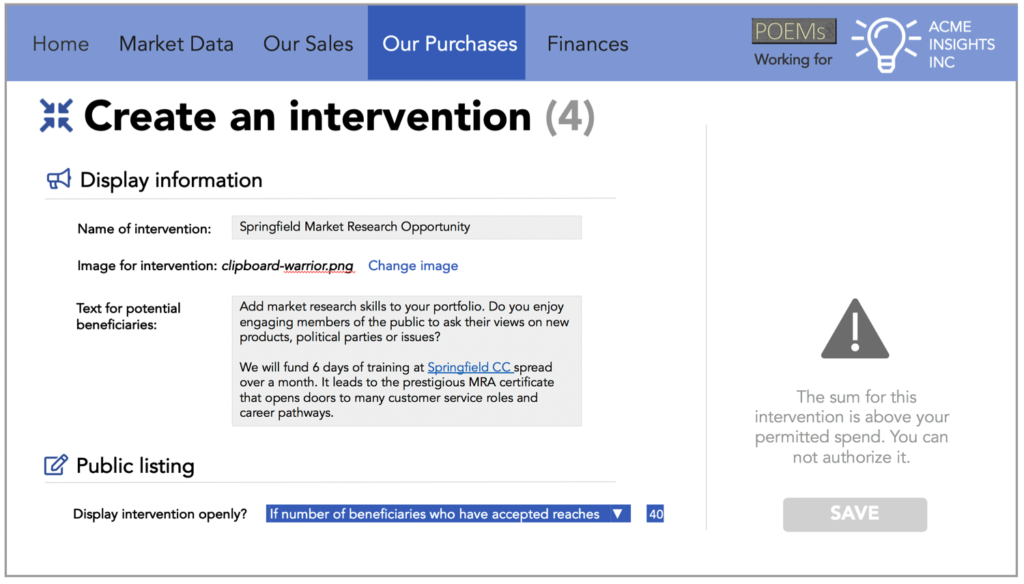

Now POEMs needs some display content for potential beneficiaries:

It’s up to Mark whether POEMs is allowed to make this fund public on its directory of interventions. Doing so would help Wall Street money find it. But he decides to only let targeted workers know about it until 40 have signed up. That gives him a chance to tweak settings for offers to later beneficiaries while Acme’s fund is still under the radar. The intervention will go to the board for directors’ approval tomorrow and be live by lunchtime.

Evening tied

As he sips coffee, Mark gets an alert from his personal POEMs account. A paid caregiver his adopted, disabled, grandson loves is suddenly available this evening. A public assistance budget for the boy’s care is in credit. It’s time for a couple of movie buffs to enjoy date night. He goes to POEMs on his phone.

As he sips coffee, Mark gets an alert from his personal POEMs account. A paid caregiver his adopted, disabled, grandson loves is suddenly available this evening. A public assistance budget for the boy’s care is in credit. It’s time for a couple of movie buffs to enjoy date night. He goes to POEMs on his phone.

As with every sector on the system, the cinema market is open to any seller who meets legal requirements, and there is no cost to market entry. Multiplexes sell, so does anyone with a home cinema installed. One of them choses random evenings when he sells seats at three sofas in his living room. Orders close at 4PM so he can plan the evening if tonight’s film doesn’t sell. To keep it legitimate, POEMs will tithe a copyright payment to the studio, refusing listings for movies not in the agreement.

POEMs allows Mark and his partner to run pooled accounts. He can see when she will finish work and wants to surprise her. As he heads out to set up for rush hour pancake research, he taps his phone to put funds into escrow, confirming one of the entrepreneur’s sofas tonight. He also books the caregiver and blocks his girlfriend, Yvonne’s, availability for the evening.

→ IMPACT: “People’s Capitalism