Across the world, in sector-after-sector, centralized platforms have displaced diversified markets. As buyers migrate to platforms in search of cheapness and convenience, sellers have to follow.

Across the world, in sector-after-sector, centralized platforms have displaced diversified markets. As buyers migrate to platforms in search of cheapness and convenience, sellers have to follow.

Seller beware

Imagine you need to sell something: an unused gift, a few hours of your time, meals in your restaurant, spare cash you want to lend, babysitting; anything.

The marketplace used to find buyers is crucial. What percentage of your potential buyers use it? How much control does it give you? Whose interests does it serve? What charges are imposed? How much data does it share?

Two decades ago, answers would have been similar for most goods and services. That’s shifted to shocking disparities across the economy. Here’s two pointers for our investigation of this trend:

- A market’s impact on sellers is key: Cool new ways to buy stuff are useful. But they won’t pay the bills. Economic impact comes from what any exchange does for its sellers.

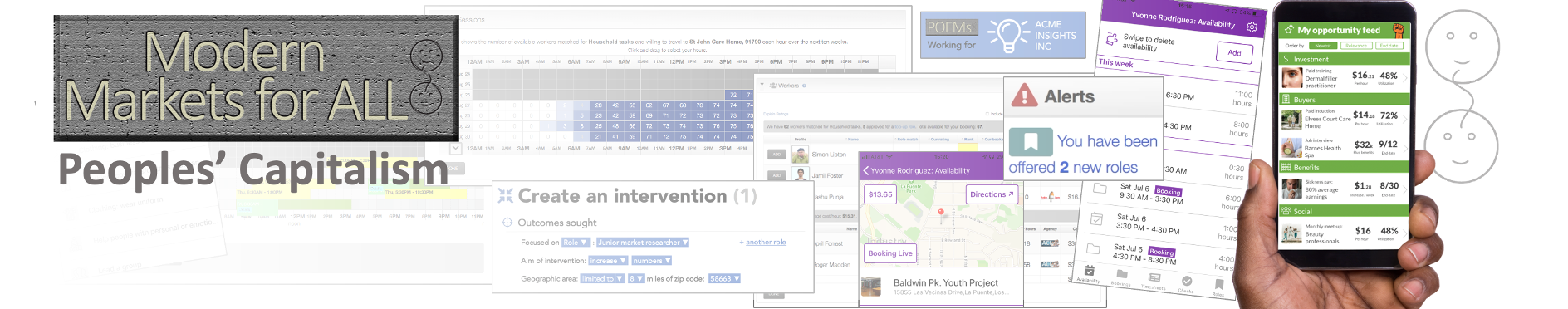

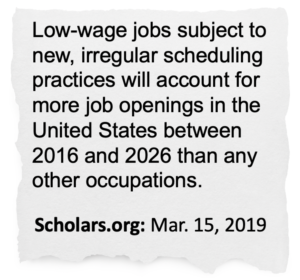

Powerful markets can be out of sight: Even pre-Covid, 41% of America’s hourly employees didn’t know next week’s hours or pay. They are just told when, or if, their employer needs them day-to-day. These breadwinners are selling their time in a monopsony (a market with only one buyer). Workforce scheduling platforms get a fraction of the scrutiny of high-profile gig work apps.

Powerful markets can be out of sight: Even pre-Covid, 41% of America’s hourly employees didn’t know next week’s hours or pay. They are just told when, or if, their employer needs them day-to-day. These breadwinners are selling their time in a monopsony (a market with only one buyer). Workforce scheduling platforms get a fraction of the scrutiny of high-profile gig work apps.

In this section:

→ Contrast: A Tale of Two Sales: Market inequality made tangible.

→ How did this Happen?: Why did market platform technologies evolve this way?

→ Consequences of Market Inequality: Financialization, and a race to the floor on wages.