E-markets are little understood, mostly out of sight. But we can’t fully see possibilities for new jobs, taming inflation, reversing inequality, accelerating growth, or greening economies without dissecting economic platforms.

E-markets are little understood, mostly out of sight. But we can’t fully see possibilities for new jobs, taming inflation, reversing inequality, accelerating growth, or greening economies without dissecting economic platforms.

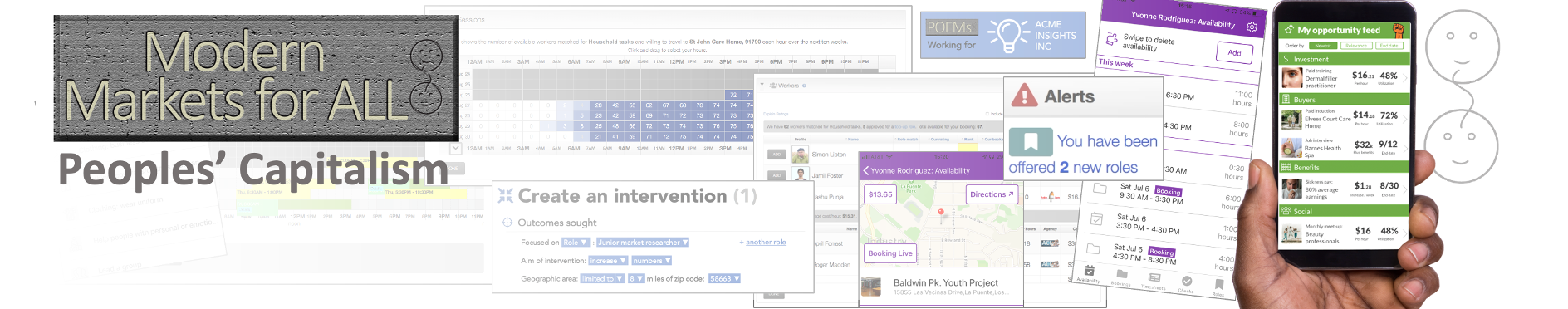

Here’s this website in 5 minutes:

1) PROBLEM: Modern Markets for Some

Powerful new technologies for buying and selling are applied very differently at the top and bottom of the economy:

- A Wall Street trader wants to sell $100m of assets. He now uses neutral, coordinated, markets unprecedented in breadth, depth, reliability, speed, risk mitigation, proactiveness, and cheapness.

- A lower-skilled single mother needs to sell her labor. Her buyers have moved to disparate, controlling, secretive, gig work platforms or employer-monopsony scheduling systems. They drive down labor costs, and can retain 30% of her earnings.

Over half of workers are now siloed into a platform, managed by algorithms. It crushes each person’s multifaceted potential. People have different assets and need different markets, but our platforms could be just as empowering as Wall Street’s.

Markets matter. They allocate resources, determine incomes, confer power, ringfence assets, and can throttle opportunity. Multiple economic problems are now underpinned by inequality of markets. → Details

2) GAMECHANGER: A Public Utility Option

We deserve a comprehensive, fully-featured, open-data, job creating, safety net providing, system of e-markets with ultra-low charges, maximizing the value of anything regular people and local businesses have to offer. That describes a regulated public utility, not another unfettered business opportunity.

We deserve a comprehensive, fully-featured, open-data, job creating, safety net providing, system of e-markets with ultra-low charges, maximizing the value of anything regular people and local businesses have to offer. That describes a regulated public utility, not another unfettered business opportunity.

Electricity, rail, roads, money, water supply, postage, telephones; all went through a wild-west pioneering phase. Then policy shaped a democratized utility version. E-markets meet criteria that justified those interventions.

Government should not fund, design, build, or operate this new utility. But politicians could issue a concession, like they do for state lotteries. So, public agencies would commit facilities that might include: (a) channeling public spending through the new system (b) allowing direct interface into official databases and processes, including the courts (c) official promotion.

In return, a consortium operating the new markets for profit would have to legally commit to 5 fundamentals of public service over a concession period of perhaps 15 years:

- The operating consortium fund everything: Not just the technology, they also finance the official interfacing and – if needed – internet access for citizens.

- Fixed transaction charge: A fixed mark-up on each purchase is the only revenue for operators. Competitive bids for the concession should lead to a flat charge under 2%.

- Small transactions mandated: This is a system to boost any transaction in the micro-economy; it focuses on barbers not biochemists, rental of bikes not bulldozers.

- Neutrality/privacy/open-data/accountability: Anyone can register, then sell or buy anything on equal terms if legal. Anyone can drill into supply/demand/pricing data for any sector. Prices are set by sellers. Users own their data and can wipe or export it.

- Decentralized operations: The consortium are independent of government. They must have a local franchisee running each market sector. Anyone can launch an interfacing app.

We call this platform initiated by concession “POEMs”: Public Official E-Markets. → Details

3) SOLUTION: Modern Markets for All

It’s hard to briefly convey how enabling “POEMs” could be. Expectations of new market technologies are stunted by today’s siloed, buyer-centric, overhead-laden, high-charge, and data-hoarding platforms.

POEMs would seamlessly trade; accommodation, beauty treatments, cash loans, deliveries, electricians, food, garment rental, home storage, industrial equipment hire, journeys, kale harvesters, luggage transfers, medical device rentals, nannies, office rentals, parking, road mending crews, security guards, textbook rentals, ushers, window repairs, x-ray slots, yoga lessons, zoo tours, and countless other sectors.

POEMs’ operators would be incentivized to constantly increase activity and earnings across the economic base; their only return is a tiny percentage of each worker or seller’s earnings. Official pump-priming should drive their markets to enormous scale. They could then exploit only-now-possible tools that give each user control while constructing pathways, and attracting investment – or official interventions – to develop each person’s earnings prospects.

No-one would have to use POEMs. But if you did, it could be opening your Total Economic Potential across skills, new jobs, and tradable assets that remain unrealized in today’s mishmash of “markets”. → Details

4) IMPACT: “People’s Capitalism”

If well executed and widely adopted, these markets could quickly expand economies. New resources would be unleashed from those at the economic base. Earnings and productivity should increase while public assistance costs decline. Innovative safety-net programs could become uniquely cost-effective to target, administer, and audit.

If well executed and widely adopted, these markets could quickly expand economies. New resources would be unleashed from those at the economic base. Earnings and productivity should increase while public assistance costs decline. Innovative safety-net programs could become uniquely cost-effective to target, administer, and audit.

Specifically, that would create impacts in:

- Greening the micro-economy: These markets would atomize services, away from centrally controlled silos to broader, more efficient, hyper-localized activity. Rentals maximize asset use.

- Ligting the left-behinds: Unemployed? A program such as “Guaranteed Work” might get you on a first rung of the economic ladder. POEMs’ data and progression tools can then kick-in to find your steppingstones up.

- Crisis response: People and resources could be mobilized from deep markets in seconds. Micro-targeting of stimulus stabilizes households quickly.

- Precision government: POEMs could very efficiently, transparently, devolve control and accountability of public services, welfare, and tax administration.

- Regional competitiveness: A country or region with POEMs would have serial advantages when attracting investment, tourism, or residents. → Details

5) ABOUT: Three Decades of Preparation

“Modern Markets for All” started in 1994 at the UK think-tank Demos. The concept has generated books, policy papers, a highly rated TED talk, and countless articles.

“Modern Markets for All” started in 1994 at the UK think-tank Demos. The concept has generated books, policy papers, a highly rated TED talk, and countless articles.

But it remains fringe. An assumption global financial institutions and aggressive startups should be left to drive a vision for market technologies goes unchallenged. Yet, history suggests better markets are inevitable. Once one country figures out how an emerging technology can upgrade their economy, others always follow. Today’s A.I. era could be the moment. Unease around tech-mediated, unbalanced, hyper-economies already runs deep.

We are a British, non-partisan, nonprofit built by the people who originated this thinking. Our recent work has focused on a taster for the overall vision: markets for Good Gig Work overseen by public employment agencies. The technologies for that were funded in British government programs. Enabled by US philanthropies, the resulting platform was also launched by public bodies in Los Angeles County at the start of the Covid pandemic. Their preparations for launch won US Conference of Mayors’ prize for best economic development initiative in America. The program expanded to other regions in 2024.

What now for the wider policy? Our hope is to find a first government that will just fully ask “Do we have an inequality of markets problem? If so what could be done?” If you can help; with finance, contacts, analysis, or just sustained tenacity in starting a regional dialogue, it could be pivotal. → Details

Thinkers on right and left have used “Peoples’ Capitalism” as shorthand for their goal of an inclusive, competitive-but-supportive, market economy. Today’s platform technologies make the concept uniquely viable….and urgently needed.

→ PROBLEM: Modern Markets for Some

Click or tap any cutting to see the full article.