The world has barely glimpsed e-markets’ capabilities. What could these technologies look like if applied to growth and inclusion at massive scale?

The world has barely glimpsed e-markets’ capabilities. What could these technologies look like if applied to growth and inclusion at massive scale?

E-Markets as a public utility: What’s different?

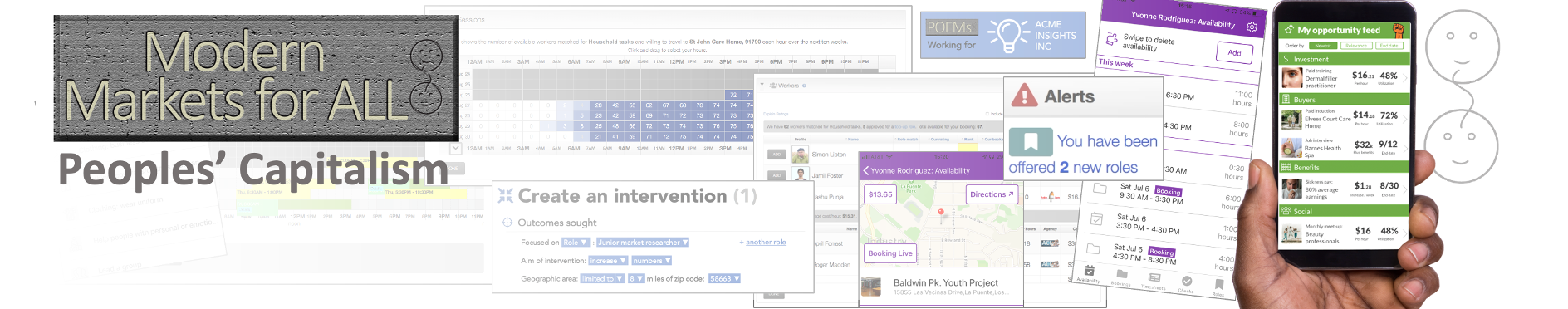

Like Wall Street’s hyper-platforms, POEMs (Public Official E-Markets) would have government underpinning. That gives them breadth, depth, solidity, and regulated predictability: a stark contrast to today’s discontinuous melee of services. The enabling legislation should then ensure operators maximize their return by delivering:

Wall Street’s hyper-platforms, POEMs (Public Official E-Markets) would have government underpinning. That gives them breadth, depth, solidity, and regulated predictability: a stark contrast to today’s discontinuous melee of services. The enabling legislation should then ensure operators maximize their return by delivering:

- Seamless markets: POEMs is not a vertical platform battling to dominate its niche. It pulls together resources from across its thousands of sectors to meet each buyer’s need. A suite of transaction mechanisms maximizes convenience. Mandated franchisees inhibit centralizing and keep each sector vibrant.

- Atomization: The flat-rate, fractional, system charge in each purchase is

- to reward operators for small transactions. Instead of upselling within a silo, POEMs aims for “broadselling”, meeting the buyer’s need in an insured, backstopped, package from many small sellers, not necessarily one big one.

- Information: Anonymized, data from POEMs is public property. Operators are motivated to harness that with tools allowing – for example – anyone to explore options around market entry, pricing, where to offer, and times to offer for any skill or asset.

- Investment: With returns linked to activity across the micro-economy, POEMs will encourage market interventions that increase its users’ options, activity, and earnings. They can come from government, philanthropy, or profit seekers.

- Externalized innovation: Banned from taking a position in any of their markets, permitted to operate only the core service, POEMs spawns spin-off opportunities that its operators can’t exploit. Instead of building a monolith, they are incentivized to tend an evolving eco-system of value-adding apps.

In this section:

→ Scope of “POEMs”: How is the platform structured?

→ “POEMs” in the Home: An opportunity-seeker logs-in.

→ “POEMs” for Businesses: A small company exploits its new facility.