Defensible policy. Up-for-grabs politics.

Defensible policy. Up-for-grabs politics.

Market failure: So many markets

Our proposed policy asserts that access to the best possible tools for economic activity should now be a universal right, like clean water. Why is that justified?

Our proposed policy asserts that access to the best possible tools for economic activity should now be a universal right, like clean water. Why is that justified?

- We have a market failure: Commercial marketplaces must advertise. To keep that cost-effective, they have to focus on a tight niche. Marketing outlay must be recouped from users. Competitors are doing the same. So unstable, shallow, expensive, skewed, markets are the best they can do.

- Doing nothing carries enormous costs: Governments have dawdled over crucial technologies in the past. Every month that regular people are denied access to state-of the-art tools for monetizing their skills or assets is a month of lost income and growth.

- Only the narrowest monopoly need be instigated: This policy does create a regulated monopoly. But corporates are successfully building untrammeled monopolies now. Policy would be creating a very narrow one, on government backed e-markets for (commercially undesirable) small transactions. For-profit platforms will remain as a choice. Other infrastructure – roads, water, electricity – have few effortless alternatives.

- Regional advantage awaits: A first jurisdiction to get this policy right will build an edge in attracting investment. A small nation moving fast might attract a consortium willing to deliver advanced digital infrastructure as a loss leader to attract bigger territories.

This would broadly be a constituent policy, instigating a private-sector entity that funds, designs, and operates the proposed marketplaces. There’s no inherent ideology in this policy, it’s just a leveling up: the aims of Karl Marx by the means of Adam Smith.

But it will be shaped by whichever side of the aisle embraces it first. B to watch in a concession include; Is functionality for unions mandated? Are the markets’ scope limited to protect institutions like banks? How independent are operators?

Could our policy aims be achieved in other ways?

Our aims shouldn’t be contentious. Here’s 5 obvious alternative routes to achieving them:

Better regulation of existing markets: Could Uber, Lyft, TaskRabbit, and their thousands of competitors be compelled to share data, become interoperable, slash charges, and offer full functionality for sellers through “platform governance“? The intensity of these firms’ battle against basic legal compliance suggests this is unlikely.

Better regulation of existing markets: Could Uber, Lyft, TaskRabbit, and their thousands of competitors be compelled to share data, become interoperable, slash charges, and offer full functionality for sellers through “platform governance“? The intensity of these firms’ battle against basic legal compliance suggests this is unlikely.- Foster unionization: Collective bargaining could be a bit 20th Century for today’s fluid, high-churn, globalized, platforms? It could help stop blatant abuses, even resulting in platforms shuttering. But we want to unlock good platforms, not just stop crooks.

- Confer official benefits on ALL e-markets: That could invite chaos with cowboy operators roaming official databases and dumping user disputes in the courts; plus public sector spending forced across countless here-today-gone-tomorrow forums.

Wait for socially-minded marketplaces to emerge: They’re trying, with negligible impact compared to the scale of need. It’s just too hard to raise funding and awareness. They crash, plateau, or sell-out.

Wait for socially-minded marketplaces to emerge: They’re trying, with negligible impact compared to the scale of need. It’s just too hard to raise funding and awareness. They crash, plateau, or sell-out.- Direct provision: Politicians could nationalize existing platforms or fund and oversee alternatives. Like state-run broadcasting, this would likely foster manipulation; engineering pre-election booms for example.

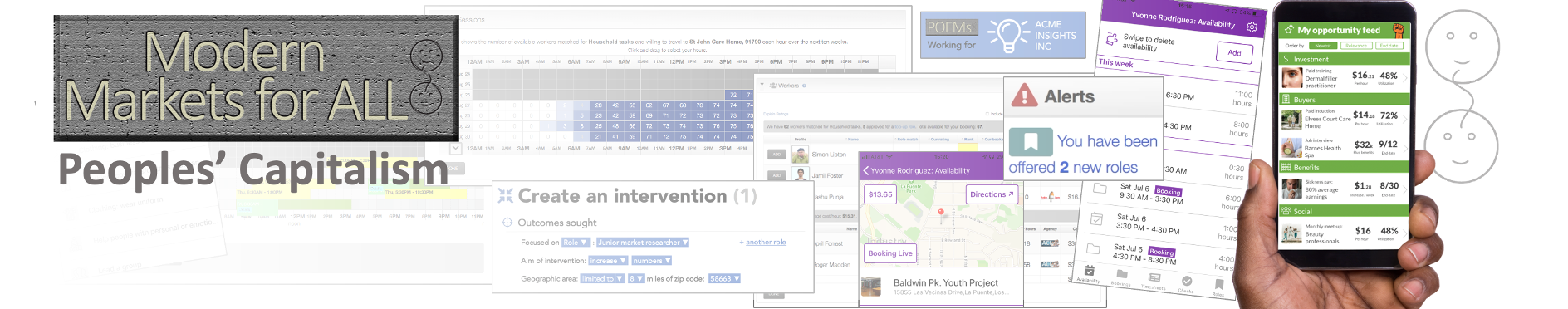

Modern Markets for All isn’t an alternative to other policies tackling economic problems. It supplements them. POEMs (Public Official E-Markets) would be a slick way of administering hybrid legal statuses for work-seekers, Universal Basic Income, or green incentives for instance. Ideally, there should be no social engineering attached to the policy. It just creates the best possible markets across the micro-economy, then allows users’ self-interest, legitimate interventions, and general economic regulation to play out.

For simplicity we are focusing here on policy for a mixed economy in a stable democracy. We have a separate briefing for other governments.

Downsides: Points-of-failure, the jobs issue

No meaningful policy is utopian. This one shares unwanted consequences with past legal frameworks for new technologies. They have proved manageable:

Centralized point of failure: Water in your city likely comes from one vast ring-main. Imagine that were disabled. Urbanites live with this risk constantly. Existing without Modern Markets for a few days is less frightening. And too-big-too-fail online services have security protocols, access controls, and failover capacity impossible to replicate in physical infrastructure.

Centralized point of failure: Water in your city likely comes from one vast ring-main. Imagine that were disabled. Urbanites live with this risk constantly. Existing without Modern Markets for a few days is less frightening. And too-big-too-fail online services have security protocols, access controls, and failover capacity impossible to replicate in physical infrastructure.

- Low value businesses suffer: Many people are employed in temporary work agencies, brokers, and other buyer-seller matching businesses. Those operations will gain multiple ways to offer value added services incorporating POEMs. But not all will do so. So, if gig work marketplaces opt not to work with POEMs they – and their investors – could suffer.

- Disadvantaging of non-users; Anyone uncomfortable around computers, or with a disability that makes usage hard, could be sidelined. It’s a common thread in new infrastructure. Telephones disadvantaged deaf citizens until accessible technologies were developed. Incentivizing comparable tools (or human assistance) for those who struggle with computers could be enshrined in a concession to operate POEMs.

- Flushing out blurred issues: Current fuzziness in labor markets is a lifeline for groups such as undocumented workers. With so much work off-the-books, they have opportunities and reduced risk of detection. If better options in public markets attract activity out of shadow economies, the gray market will shrink; possibly becoming only those who are not legally permitted to earn. If policymakers wish, this could be mitigated by a concession mandating anonymous users be allowed in POEMs.

A common fear about better markets for fluid economic activity is that they will erode traditional jobs. Won’t employers just turn to on-demand workforces? They are certainly doing so at present to cut costs. But large scale, more equitable, markets shift power back to workers because each person gains so many options. The resulting market forces should reverse cheapening of labor with on-call workers costing the same, or more, per hour than full timers. And no on-call worker can match the organizational knowledge, relationships, and brand ambassadorship of a committed full-timer.

But, if issues like job erosion trouble policymakers they can mitigate. POEMs would generate a financial surplus from commission on big purchases, which fall outside its Maximum Average Transaction Size constraint. That surplus could pay a “stability bonus”, rewarding operators when a user moves into a job. That would deliver a platform relentlessly driving job creation.

Politics: Infrastructure ignites

Money supply and Markets are the basic enablers of capitalism. Every country strives for a stable official currency to facilitate trade. Doing the same for marketplaces has become vital in our era of market inequality.

Money supply and Markets are the basic enablers of capitalism. Every country strives for a stable official currency to facilitate trade. Doing the same for marketplaces has become vital in our era of market inequality.

This is not just an administrative issue. If hardworking breadwinners are not getting opportunities to progress because platforms they have to use to find buyers are skewed against them, that should be a fundamental bipartisan injustice. It can be framed in many ways.

Economic infrastructure can be a galvanizing issue. In 1836 a youthful American federal government stopped issuing currency. The result,“Wildcat banking”, spawned thousands of incompatible money systems. Some were good for limited purposes. Many were valueless.

The one choice Americans didn’t have for the next three decades is the facility we take for granted today; a stable, too-big-to-fail, official money system. None of the 15,000 free banking note issuers could come up with any enduring advantage over the others across the whole economy. Confused citizens gave up on cash and turned to barter. Campaigns for a government issued currency became a fiery political cause.

The one choice Americans didn’t have for the next three decades is the facility we take for granted today; a stable, too-big-to-fail, official money system. None of the 15,000 free banking note issuers could come up with any enduring advantage over the others across the whole economy. Confused citizens gave up on cash and turned to barter. Campaigns for a government issued currency became a fiery political cause.

The 1863 National Currency Act finally stabilized money. It enabled financial innovations unthinkable in an era of opportunistic note issuers.

In the 2020’s we have wildcat markets. The shifting, time consuming, nature of online trade for regular people ensures many transactions occur without it and stifles innovation. Addressing this waste of economic potential offers a new pocketbook issue. And official markets could be loved. Even after decades of vibrant commercial mail delivery options, for example, the government-enabled US Post Office manages an astonishing 90% positive rating with voters.

Disrupting the disrupters

Current digital policy often boosts big players. Ubiquitous broadband for example will help citizens find work and meet their needs. But they tend to do it at Uber, Amazon, and other deep services. A Modern Markets policy offers a better destination, not just a faster journey.

Who will the opposition be? Low value-add companies (online or offline) who fear POEMs as a choice for their customers will rage. (Others will build a value-adding business on top of the basic public platform.) Shadow economies will also take a hit, but they don’t have lobbyists.

Unfortunately, it’s easy to see how even limited opposition could be fomented into a wave. Detractors will likely tap visceral feelings about the “M” word, and the “G” word:

- Markets: Yes, this is about expanding market access just as many on the left have had their fill of market-driven solutions. But their revulsion could be because this generation is so used to “markets” ranged against them. It doesn’t have to be that way.

Government: It needs repetition: governments shouldn’t fund, design, or run these new markets. Policymakers unlock official facilities, ensure they pass to commercial operators in a transparent process, then get out of the way.

Government: It needs repetition: governments shouldn’t fund, design, or run these new markets. Policymakers unlock official facilities, ensure they pass to commercial operators in a transparent process, then get out of the way.

Opponents may not want to use official markets. That’s fine, they are also free to opt out of municipal electricity and other publicly provided facilities. That doesn’t confer a right to deny the same choice to everyone else.

→ THE SOLUTION: Modern Markets for All